Why Traditional ROI Metrics Miss AI's True Value

Your CFO walks into the board meeting with the quarterly AI report: "We've automated 15% of our customer service tickets and reduced processing time by 3 minutes per call." The board nods politely, approves continued funding, and moves to the next agenda item. What they don't realize is that they just missed the most important conversation of the quarter.

The uncomfortable truth is that traditional ROI metrics were designed for industrial automation, not intelligent transformation. When executives measure AI impact through cost savings alone, they fundamentally misunderstand what they're building. According to BCG and MIT research, organizations using AI-powered KPIs are five times more likely to effectively align incentive structures with objectives compared to those relying on legacy metrics. The companies that will dominate the next decade aren't those squeezing pennies from AI, they're the ones unlocking exponential value creation that traditional finance frameworks can't even measure.

What Enterprise Valuation Means in the AI Era

Enterprise valuation in 2025 isn't about assets - it's about intelligence architecture. The market increasingly values companies based on their ability to generate, process, and monetize data-driven insights at scale. Yet most boards still evaluate AI investments using the same frameworks they'd apply to new manufacturing equipment. Research from Andreessen Horowitz reveals that 100 enterprise CIOs across 15 industries are fundamentally restructuring how they budget for AI, shifting from project-based ROI to architectural value creation. The difference? Cost-center thinking treats AI as expense optimization. Growth-engine thinking treats AI as competitive moat expansion. When Salesforce reports that AI-driven CRM analytics result in 20% increases in sales forecasting accuracy, they're not celebrating operational efficiency. They're demonstrating predictive intelligence capabilities that compound competitive advantage over time. The Enterprise Value Framework: Beyond Traditional Metrics

Successful CEOs measure AI impact through three interconnected value drivers that directly correlate with enterprise valuation multiples: Offensive Value: Revenue and Margin Enhancement

Revenue Attribution Through AI Capabilities

- Customer lifetime value optimization driven by predictive personalization

- Market expansion enabled by AI-powered product development

- Pricing optimization through real-time competitive and demand intelligence

Measurable Impact Indicators:

- Percentage of revenue influenced by AI-driven initiatives

- Customer acquisition cost improvements from predictive lead scoring

- Average order value increases from AI-powered recommendations

Companies using AI for revenue analytics report an average revenue increase of 10-15%, with 83% of AI-enabled sales teams experiencing revenue growth compared to 66% without AI capabilities. Defensive Value: Risk Mitigation and Operational Intelligence

Enterprise Risk Reduction Through Predictive Capabilities

- Supply chain disruption prediction and response automation

- Customer churn prevention through behavioral pattern recognition

- Regulatory compliance monitoring and predictive remediation

Strategic Protection Indicators:

- Reduction in operational surprise incidents

- Improvement in forecast accuracy for board-level planning

- Decrease in compliance-related risks and associated costs

Research shows companies integrating AI into forecasting see 40% improvements in forecast accuracy, enabling better strategic decisions and reducing enterprise risk exposure. Strategic Value: Market Position and Competitive Differentiation

Competitive Moat Creation Through AI Architecture

- Proprietary data advantage that strengthens over time

- AI-enabled customer experience differentiation

- Market intelligence capabilities that inform strategic positioning

Long-term Value Creation Measures:

- Speed of new product/service introduction enabled by AI insights

- Customer retention improvements from AI-powered personalization

- Market share protection through AI-driven competitive intelligence

The Board-Level AI Valuation Dashboard

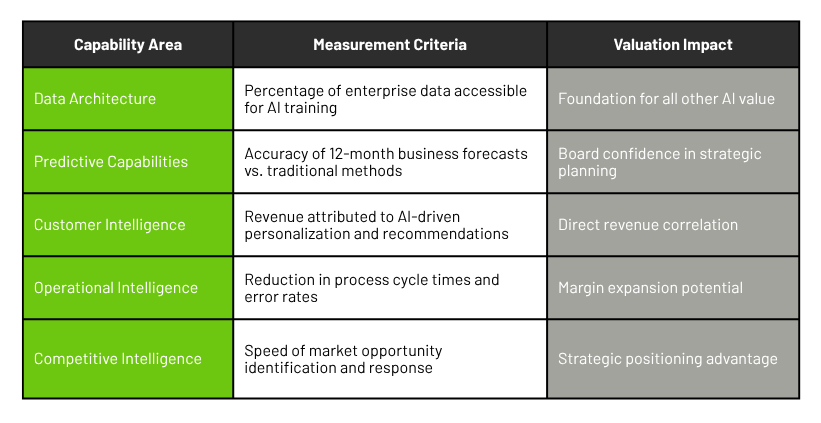

Traditional boards track lagging indicators. AI-mature boards track leading indicators of enterprise value creation. Here's the executive dashboard framework that correlates AI investments with valuation multiples:

Intelligence Maturity Index

Value Creation Attribution Model

Hard Value Metrics (Immediate P&L Impact):

- Revenue growth attributable to AI-enabled capabilities

- Cost reduction through intelligent process automation

- Margin expansion from AI-optimized pricing and resource allocation

Strategic Value Metrics (Long-term Competitive Position):

- Customer lifetime value improvements from AI-powered experiences

- Time-to-market acceleration for new products/services

- Market share protection through AI-enabled differentiation

Enterprise Risk Mitigation Metrics:

- Reduction in operational disruptions through predictive intelligence

- Improvement in regulatory compliance through automated monitoring

- Enhancement in strategic decision quality through data-driven insights

How Leading CEOs Communicate AI Value to Boards

The most effective AI presentations to boards don't start with technology—they start with enterprise value creation. Here's the framework that works: The Three-Horizon AI Value Story

Horizon 1 (0-12 months): Operational Excellence

Present measurable improvements in current business operations with specific ROI calculations and competitive benchmarking.

Horizon 2 (1-3 years): Competitive Advantage

Demonstrate how AI capabilities create sustainable differentiation and market position strengthening.

Horizon 3 (3+ years): Market Leadership

Show how AI architecture enables business model innovation and market expansion opportunities.

Board Communication Best Practices

Lead with Enterprise Impact, Not Technical Capability

Instead of "Our AI model achieves 94% accuracy," say "Our predictive intelligence reduces customer churn by 15%, contributing $2.3M annually to enterprise value."

Connect AI Metrics to Board-Tracked KPIs

Link AI performance directly to existing board metrics: revenue growth, margin expansion, market share, customer satisfaction, and operational efficiency.

Show Competitive Positioning Context

Benchmark AI capabilities against industry leaders, not just direct competitors, to demonstrate strategic positioning.

Frequently Asked Questions: AI Valuation Measurement

Q: How do we separate AI impact from other business improvements?

A: Use control groups and baseline measurements to isolate AI contributions. Track performance before/after AI implementation while controlling for other variables.

Q: What if our AI benefits are mostly "soft savings" rather than hard ROI?

A: Quantify soft savings through productivity measurements and opportunity cost analysis. Time saved can be converted to strategic capacity for growth initiatives.

Q: How often should we report AI value creation to the board?

A: Quarterly strategic reviews with detailed annual assessments. AI transformation moves too quickly for annual-only evaluation.

Q: Should we include AI investment costs in enterprise valuation discussions?

A: Yes, but frame total cost of ownership against long-term competitive advantage creation, not just immediate ROI payback periods.

Q: How do we benchmark our AI value creation against competitors?

A: Focus on industry-standard metrics like customer acquisition cost, lifetime value, forecast accuracy, and operational efficiency improvements that can be compared across companies.

The Valuation Multiple Effect

Companies demonstrating measurable AI-driven value creation command higher valuation multiples. Research from Fortune reveals that firms using "smart KPIs" powered by AI are three times more likely to see greater financial benefit than those relying on traditional metrics. This isn't theoretical. Private equity firms increasingly evaluate AI integration depth during due diligence processes, recognizing that AI architecture capabilities directly correlate with sustainable competitive advantage and long-term value creation potential. The market rewards companies that can demonstrate:

- Predictable revenue growth through AI-enabled customer intelligence

- Margin expansion through intelligent operational optimization

- Risk mitigation through predictive enterprise management

- Competitive differentiation through proprietary AI capabilities

Why This Measurement Framework Matters for RevvedUP 2026

The CEOs and CFOs joining RevvedUP 2026 (March 23-24, The Vinoy Resort, St. Petersburg, FL) understand that AI valuation isn't an accounting exercise - it's a strategic imperative. In markets where B2B and B2C models are converging, the companies that can demonstrate measurable AI-driven value creation will attract capital, talent, and customers. RevvedUP 2026 brings together leaders who've moved beyond pilot programs to architectural transformation sharing specific methodologies for measuring and communicating AI's impact on enterprise valuation. Because leaders that understand AI value creation will govern the companies that redefine their industries.

👉 Join RevvedUP 2026 For many of those leaders, the work continues well beyond the event itself. Revenue Room™ CXO serves as the ongoing peer environment where these valuation frameworks are tested against real operating decisions, board expectations, and market pressure. It is where CEOs and senior executives refine how AI strategy shows up in governance, capital conversations, and enterprise value creation over time.